🔍 Overview

This application uses machine learning models (Random Forest and GRU) to forecast Bitcoin prices across short- and long-term horizons. Tree-based models handle near-term fluctuations, while GRUs capture long-term patterns.

🧠 Learning & Tech Stack

This project helped me apply machine learning to financial time series, combining traditional and deep learning models in a production-ready pipeline.

- 💻 Python – data processing, modeling, and automation

- 📊 Scikit-learn & Keras – for training and experimenting with multiples ML and DL models (RF, XGBoost, LSTM, GRU)

- 📈 Feature Engineering – lagged prices, technical indicators (MACD, EMA, Bollinger Bands, etc.)

- 🌐 Multi-source Data – macroeconomic, on-chain, and sentiment features

- 🧪 Model Evaluation – test sets, rolling predictions, performance metrics

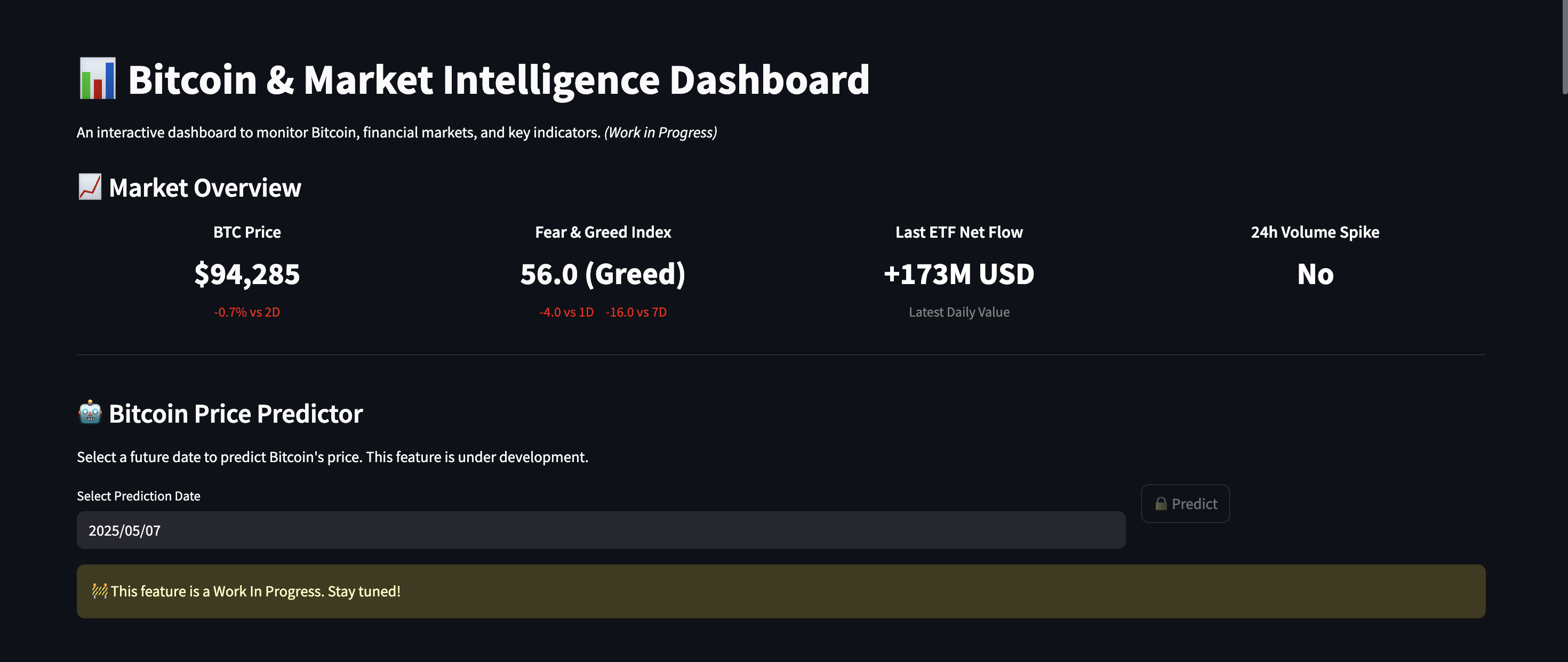

- 📤 Streamlit Deployment – interactive prediction interface

- 🗂️ GitHub & Versioning – code management and reproducibility

✨ Features

- 📆 Predict BTC prices for both short- and long-term horizons

- 🛠️ Toggle between GRU and Random Forest models

- 📈 Visual forecast charts with actual vs. predicted prices

- 📊 Feature importance breakdown (Random Forest)

- 🔁 Recursive prediction logic with simulated lag features

- 💬 Streamlit app for input, explanation, and download

🧠 Model Architecture Preview

Below is a preview of the model training and prediction interface: